WHAT IS IDLC SIP? WHAT IS THE RETURN POTENTIAL / HISTORY?

WHAT IS IDLC SIP? WHAT IS THE RETURN POTENTIAL / HISTORY?

IDLC Systematic Investment Plan (IDLC SIP) is a simple, convenient and disciplined way to make investment to fulfill your life goals. Through IDLC SIP, you can invest a fixed amount of money every month for a specific time period in a suitable mutual fund available for you. IDLC SIP also gives the opportunity to ensure that your financial goal is achieved even at your absence, through life insurance coverage at a very low premium (non-refundable).

As on June 30, 2025 - Average Annual Compounded Return from first published NAV of our 3 Mutual Funds are: IDLC BALANCED FUND (IBF): 6.49%, IDLC GROWTH FUND (IGF): 7.15%, IDLC AM SHARIAH FUND (IDLC AM SF): 1.82%; First published NAV dates are: IDLC BALANCED FUND (IBF) - 20/07/2017, IDLC GROWTH FUND (IGF) - 24/05/2018, IDLC AML SHARIAH FUND (IAMLSF) - 12/12/2019 ****Investment in Mutual Fund is subject to market risk. Past performance does not guarantee future results.

You can open IDLC SIP account anytime with IDLC Asset management Limited by submitting the required documents along with the IDLC SIP form. Just decide on the following four options and design your IDLC SIP to achieve your financial goals:

On the maturity of the IDLC SIP tenure, you can fully liquidate your investments by selling the units to IDLC AML at the prevailing surrender price. However, IDLC SIP gives you the flexibility to withdraw your investment anytime, fully or partially, without any penalty or charge.

BENEFITS OF IDLC SIP

TAX SAVINGS

Investors can enjoy substantially higher annual tax rebates (up to BDT 75,000) compared to traditional DPS (up to BDT 18,000), making it an attractive avenue for optimizing tax efficiency and maximizing overall returns on investments.

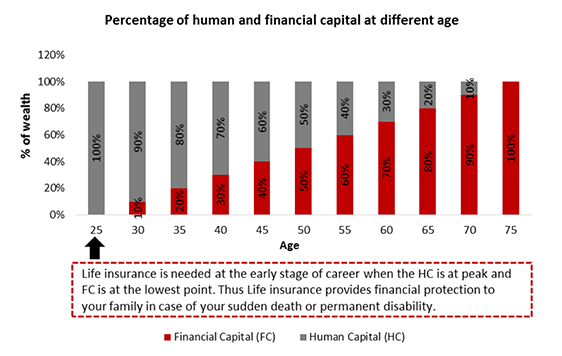

An individual’s total wealth is composed of both human capital (HC) and financial capital (FC). HC is the present value of the expected future salary, business profits etc. On the other hand, FC is the sum of all other assets that investor possess e.g. stocks, bonds, home, car etc.

Generally, at the early stage of career, HC is at peak as the person is expected to earn for a longer time in future, while the financial capital is at the lowest point. As career progresses, people build up their FC by saving and investing part of their HC (see figure below)

IDLC SIP gives you the opportunity to build your target FC through investing part of your income regularly with the additional feature of life insurance to ensure that your target FC is created even at your sudden death or permanent disability. You can avail life insurance coverage of an equivalent amount of your total investment in IDLC SIP, up to a maximum of BDT 1,00,00,000.0 (1 crore Taka).

According to your total investment in IDLC SIP, find out the total life insurance coverage and required premium below: (excel sheet: Insurance Premium Calculation)

IDLC SIP gives you the flexibility to withdraw your investment anytime, fully or partially, without any penalty or charge. So, you can always fulfill your emergency financial needs anytime through IDLC SIP.

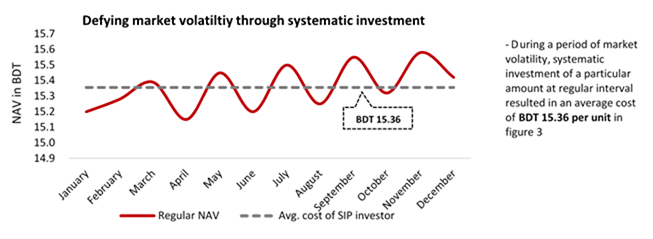

DEFY MARKET VOLATILITY

Volatility is an inherent characteristics of market. Investors are always in a fix in identifying the right time to invest. Practically, it is extremely difficult to identify the peak and bottom of the market and act accordingly, which requires extensive research and time.

IDLC SIP resolves this dilemma by periodically investing your funds across the market cycles, thus freeing you from the worries of market movements.

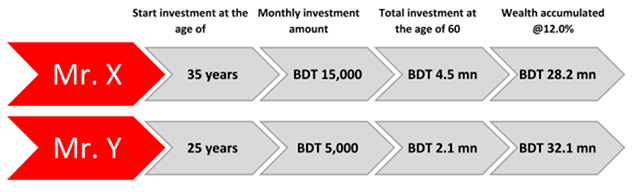

POWER OF COMPOUNDING

When you start investing early and for a longer period, you get the benefit of compounding. The illustration below shows how you can accumulate greater wealth by starting investing early even with a small amount.

Disclaimer: The above example is only for illustration purposes & shall not be construed as indicative yields