Frequently Asked Questions

Frequently Asked Questions

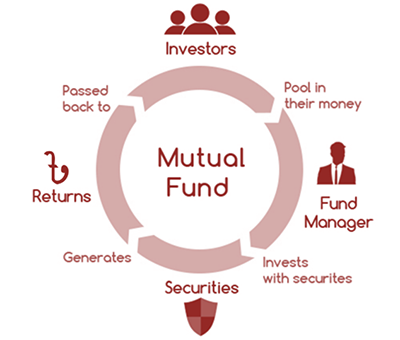

Mutual fund is a professionally managed investment vehicle that pools money from many investors to invest in securities such as stocks, bonds, money market instruments and similar assets across a wide range of industries and sectors. Mutual funds are managed by professional asset managers to attain the investment objectives of the investors of the fund.

Open-end – A type of mutual fund that does not have a maturity period so investors can buy and sell units through the asset manager on a continuous basis. There are also no restrictions on the amount of shares the fund can issue.

Close-end – A type of mutual fund that has a fixed maturity period and issues a fixed number of shares during a certain period at the time of launch. Investors can invest in the fund at the time of the IPO and thereafter, they can only buy and sell units through Stock Exchanges.

There is no guaranteed percentage of return. Empirically, it has been observed that mutual funds can generate higher return than all other asset classes in the long run.

There is no guaranteed percentage of return. Empirically, it has been observed that mutual funds can generate higher return than all other asset classes in the long run.

Profit is not guaranteed when investing in IDLC Balanced Fund. However, mutual funds can generate better returns in the long-run even in volatile markets leveraging professional fund management skills.

An expert fund manager is a skilled professional capable of generating better returns and managing risks through dynamic asset allocation.

Bangladesh Securities and Exchange Commission (BSEC) is the regulatory body of Mutual Funds in Bangladesh.

Sponsor: The sponsor initiates the mutual fund by subscribing minimum 10% of the total fund size. The Sponsor appoints the trustee, Custodian and the Asset Management Company.

Trustees: The board of trustees are responsible for protecting the interests of the unit holders. It is an independent body having received the trusteeship license from the regulator and is not associated with the Sponsor or the Asset Management Company.

Custodian: The custodian is responsible for physical handling and safe keeping of the assets managed by the Asset Management Company. They receive the Custodian license from the regulator and are independent of the Sponsor or the Asset Management Company.

Asset Management Company (AMC): The Asset Management Company is responsible for floating and managing the mutual funds in accordance with Bangladesh Securities and Exchange Commission regulations and guidelines provided by the Trustee.

Net Asset Value (NAV) is defined as the market value of all assets in the fund less liabilities. NAV is generally declared on per unit basis, dividing the total Net Asset Value by the outstanding number of units of the fund. NAV is published on a weekly basis (every Sunday) on our website: http://aml.idlc.com/nav.php

A fund’s NAV goes up or down depending on change in market value of the assets held by the fund. Therefore, if the market value of the assets falls substantially, there is a chance of the NAV going below the face value of the fund. However, such events are expected to be temporary as NAV is projected to grow in the long term with expert asset management.

Yes. IDLC AML Shariah Fund is a Shariah compliant investment tool which aims to generate profit by investing in a portfolio of Shariah compliant securities, vetted by the Shariah Advisory Board.

IDLC Balanced Fund/ IDLC Growth Fund/ IDLC AML Shariah Fund:

3% of the "Investor's Sale Price" if surrendered before 90 calendar days of purchasing units

IDLC Income Fund:

2.0% of the “Investor’s Sale Price” if surrendered before 90 calendar days of purchasing units

1.5% of the “Investor’s Sale Price” if surrendered from 90 to less than 180 calendar days of purchasing units

1.0% of the “Investor’s Sale Price” if surrendered from 180 to less than 360 calendar days of purchasing units

For IDLC SIP Investors, tenure for implementing Exit Load will be calculated from 1st SIP Installment Date

Shares which represent the extent of ownership in a mutual fund is called a unit. Investors can purchase or redeem units at the fund’s current Net Asset Value (NAV) per share.

The below formula is used to determine the Fund’s Per Unit NAV:

Total NAV of the fund = Value of Assets – Liabilities

NAV per unit = Total NAV of the fund / No. of units outstanding

The NAV of all mutual funds of IDLC is declared on Sunday every week on our website, via SMS and in Financial Express.

|

Fund Size (in BDT Crore) |

Highest Allowable Management Fee |

|

Less than 5 |

2.5% |

|

5 < 25 |

2.0% |

|

25 < 50 |

1.5% |

|

> 50 |

1.0% |

|

Source: Page 601-602, Chapter 9, Section: Securities & Exchange Commission (Mutual Fund) Rules 2001. |

|

A commission fee applied when initially purchasing units in a mutual fund, which is deducted from the total investment amount. There is NO front-end load for mutual funds of IDLC making it most-beneficial for the investors.

The Discount / Charge below the NAV that is paid by unitholder when he / she redeems units from the Mutual Fund Scheme.

Both Individual (singly or jointly) and Institution (local and foreign) can invest in a mutual fund. In addition, other mutual funds and collective investment schemes can also invest in a mutual fund.

REQUIRED DOCUMENTS for Mutual Fund Application are as follows:

|

Documents |

Quantity |

|

Applicant's NID / Passport copy |

1 |

|

Nominee's NID / Passport copy |

1 |

|

Applicant's passport-size Photo |

2 |

|

Nominee's passport-size Photo |

1 |

|

Applicant's Bank Statement (last 6 months) OR Photocopy of a blank cheque leaf |

1 |

|

Applicant's E-TIN Certificate copy |

1 |

|

Account Payee Cheque in favor of the Fund |

1 |

Please note, all documents / photos should be signed by the applicant.

We invest in stocks, bonds and other money market securities to generate maximum risk adjusted return. Full investment portfolio will be disclosed on a quarterly basis. To view Asset Manager’s Report and Portfolio and Financial statements, please visit http://aml.idlc.com/statements.php

Two types of returns any investor can get from investing in mutual fund:

Capital Gain

Dividend

Investor can submit the money (cheque / pay order / demand draft) to the head office of IDLC AML or any selling agent as appointed by the Asset Management Company. The investor can directly deposit / BEFTN the fund in the designated bank account of the mutual fund.

Yes, it is mandatory to have a BO account as units of the mutual fund will be credited to the designated BO account of the unit-holder.

To open an account with IDLC Securities Limited, the opening fee is BDT 450.00 and the annual fee is BDT 450.00. However, there is no BO account opening fee for existing account-holders.

No, there is no lock-in period in the investment of the mutual fund.

The units can be transferred from one unit-holder to another through the Asset Management Company.

No, it is not mandatory to have an E-TIN certificate. However, the unit-holder having E-TIN Certificate will have to pay only 10% tax (AIT) against dividend income. On the other hand, the unit holder who doesn’t have any E-TIN will have to pay 15% tax against dividend income.

Yes, there is a monthly deposit scheme for the mutual funds managed by IDLC Asset Management Company which is known as SIP (Systematic Investment Plan).

The minimum amount to invest in our mutual fund is 500 units for individuals and 5000 units for institutions. In terms of taka, the amount is equivalent to 500 OR 5000 units x Investor’s Buy Price. Investors must also purchase units in increments of 500.

For example: If the Investor’s Buy Price is BDT 10.06, the minimum amount one can invest = BDT 10.06 x 500 units = BDT 5,030.

(To check this week’s Investor’s Buy Price, please visit http://aml.idlc.com/nav.php)

Please note there is no maximum purchase amount as investors can purchase infinite units in multiples of 500.

The price or NAV an investor can buy units of an open-ended fund is called an investor’s buy price.

The price or NAV an investor can repurchase or sell units of an open-ended fund is called an investor’s sell price.

Yes, investors can buy units after IPO. The difference is that during IPO investors purchase units at face value, which is BDT 10.0, whereas, after the IPO closing, investors purchase units at the investor’s buy price declared by the Asset Management Company.

During IPO, investors must purchase at face value of BDT 10.00:

Individuals: 1 lot = 500 units

Face Value: BDT 10.00

Minimum Investment: 500 units x BDT 10.00 = BDT 5,000

After IPO, investors must purchase at NAV, which can be higher or lower than face value:

Individuals: 1 lot = 500 units

Net Asset Value: BDT 10.20 (for example)

Minimum Investment: 500 units x BDT 10.20 = BDT 5,100

OR

Net Asset Value: BDT 9.80 (for example)

Minimum Investment: 500 units x BDT 9.80 = BDT 4,900

The sale proceeds will be credited to the bank account of the unit-holder within 2 working days, subject to the availability of DP40 report from respective Broker after surrendering the units. Please ensure the submission of Surrender Form (to the Asset Manager) and CDBL Transfer Form (to the designated Broker House) to complete the Surrender Procedure. Refer to http://aml.idlc.com/forms.php for all forms.

Yes, an acknowledgement slip will be provided while you submit the “Purchase Form” along with the cheque. A “Confirmation of Unit Allocation” will be issued in favour of the unit-holder after crediting the units to the BO account of the unit-holder.

Every investor of mutual funds of IDLC will have access to Unit Allocation Certificate on our digital platform. To access your certificate and all other investment information, please log in with your provided username and password here: http://digital.aml.idlc.com/auth/login > REPORTS > CONFIRMATION OF UNIT ALLOCATION

Risks associated with mutual fund: abundance

The dividend (Cash / CIP, in the form of Units) will be credited to the Bank / BO account of the unit-holder within 45 days after declaration of dividend in the trustee meeting.

Investors can subscribe/purchase the units of mutual funds of IDLC through any of the IDLC branches listed on our website or through designated Selling Agents of IDLC. To learn more, please contact us via call center (16409) or “Invest Now” option provided in the website.

Investment in Mutual Funds are generally for long terms. The decision on how long one needs to stay invested, depends on investment objective. Investors need to periodically review investment status and progress. During such reviews, decisions to redeem, switch, invest or leave alone are usually made.

Cost Averaging is investing a fixed amount on a regular basis for a long-term to take the advantage of the market cycle. As the investment amount is fixed, more units are purchased when price is low and fewer when price is high. Suppose, X invested BDT 60,000 at a time, while Y invests the same amount but in an installment of BDT 5,000 every month for a year. The table below illustrates how their investment would behave:

So, Y ended up with more units as his average cost reduced to BDT 11.12 as over a period of time market fluctuations are averaged.

Scenario 1 - Auto-renewal: If investor selects the auto-renewal option in SIP section of the application form, then installments will continue until further notice from the investor.

Scenario 2 – Surrender: If investor does not want to renew the SIP after maturity, then the matured amount will be kept in his / her BO account or transferred to the investor’s bank account as per his / her choice mentioned in the Application Form.

Scenario 3 – No Auto-renewal and No encashment/redemption: If investor does not want to renew the SIP after maturity but wants to remain invested, then the matured amount will continue as a NON-SIP scheme till surrender. In this case, the investor will not have to pay a fixed amount on a monthly basis as the matured amount will be invested as a lump sum amount till he/she decides to surrender the units.

The maximum amount of SIP installment is BDT 1,000,000 per registration for individuals. There is no maximum limit for institutions.

To discontinue the SIP, the investor must provide an application to the Asset Manager at least 5 working days before the next Installment Date.

Exit Load of IDLC Balanced Fund/ IDLC Growth Fund/ IDLC AML Shariah Fund:

3% of the "Investor's Sale Price" if surrendered before 90 calendar days of purchasing units

IDLC Income Fund:

2.0% of the “Investor’s Sale Price” if surrendered before 90 calendar days of purchasing units

1.5% of the “Investor’s Sale Price” if surrendered from 90 to less than 180 calendar days of purchasing units

1.0% of the “Investor’s Sale Price” if surrendered from 180 to less than 360 calendar days of purchasing units

For IDLC SIP Investors, tenure for implementing Exit Load will be calculated from 1st SIP Installment Date

There are no penalties for default. However, the default of 6 (six) installments will result in discontinuation of SIP, and 2 (two) installments will result in discontinuation of Insurance coverage, if availed. If investor wants to continue his SIP again, he/she will have to re-register as a new SIP account.

The investor can top-up his / her installment amount for maximum 2 times against the same registration number. In that case, the investor has submit the revised “Auto Debit Instruction Form” authorized from his / her bank having the same maturity date as mentioned earlier.

Yes, the minimum investment amount is BDT 3,000.

There is no minimum lot size of units under the SIP. Any fraction amount remaining will be converted when it sums up to one unit. If at surrender, remaining amount does not sum up to 1 unit then the remaining amount will be transferred via BEFTN.

Payment in respect of the first installment can be made using a cheque / Pay Order / Demand Draft. The payment for all the subsequent installments will have to be through Direct Debit facility/Auto-Debit/standing instruction facility as provided by the investors.

An arrangement made with the bank that allows IDLC to transfer a fixed amount (as instructed by investor) from investor’s account on an agreed date.

Request for change in bank account information should be submitted at least 5 working days before the next installment date.

No, the investor cannot pay a lump sum amount in advance for SIP. He/she will have to pay a pre-determined fixed installment every month at the investor’s discretion.

Yes, investor may surrender his/her units partially and continue SIP installments till maturity.

1st of every month. If the investor defaults on that day, the auto-debit will occur on 12th of that month at the prevailing NAV of that week.

Purchase Price will be valid from Sunday to Wednesday. However, if the 7th or 15th is a Thursday, investors will be able to avail on the prevailing purchase price of that particular week.

Auto-debit will take place on the following working day on that week’s purchase price.

Yes. Minimum installment is BDT 10,000.

Yes with two different registration numbers.

Yes with two different registration numbers.

No, investors must surrender current SIP account and register again for his/her preferred mutual fund.

Yes. Cash or reinvestment units as preferred by the investor.

EXPLORE

FORMS &

DOWNLOADS

FEEDBACK

SEND US YOUR FEEDBACK. WE

WOULD LOVE TO HEAR FROM YOU.

COPYRIGHT 2019 | IDLC ASSET MANAGEMENT LIMITED

For Individual investor, following documents are required –

For institutional investor, following documents are required –

| MUTUAL FUNDS | *DPS | **FDR | |

|---|---|---|---|

| Maximum eligible investment for tax rebate (BDT) | 0 | 0 | 0% |

| You can save tax amounting to (BDT) | 0 | 0 | 0% |

| Return through tax savings | 0 | 0 | 0.0% |

Based on your taxable income, if you invest the maximum allowable investment of BDT for tax rebate in IDLC SIP, you can save BDT in taxes; implicitly earning on your investment merely through tax savings.

*Maximum eligible investment in DPS for tax rebate is BDT 120,000.

**Investment in FDR is not eligible for tax rebate

YOUR TOTAL INVESTMENT AMOUNT STANDS AT 0 BDT

YOUR EXPECTED WEALTH STANDS AT 0 BDT AFTER 0 YEARS

Result: You can avail an insurance coverage of BDT at a monthly insurance premium of only BDT