WHAT IS MUTUAL FUND?

WHAT IS MUTUAL FUND?

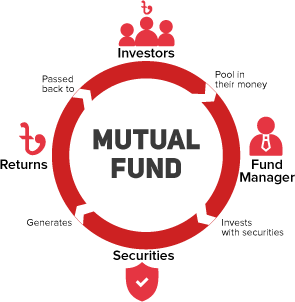

Mutual fund is an investment tool where fund is collected from many investors and invested in a portfolio of securities (e.g. equities, bonds, money market securities etc.) which is managed by investment professionals.

">" scrolling="no" src="" width="100%">

INVEST IN YOUR PREFERRED WAY IN IDLC MUTUAL FUND

BENEFITS OF MUTUAL FUND

Making good investment decisions entails a lot of time and hard work including research, analysis, market timing and constant tracking. Generally, people lack the specialized skills and/or time needed for making good investment decisions. By investing in mutual fund, you can get your fund managed by professional fund managers who have that specialized skills and experience.

Mutual Funds make diversified investment in different categories of securities e.g. equities, bonds, money market instruments etc. which reduce the risk associated with the total investment portfolio.

Investors can enjoy substantially higher annual tax rebates (up to BDT 75,000) compared to traditional DPS (up to BDT 18,000), making it an attractive avenue for optimizing tax efficiency and maximizing overall returns on investments.

Find out below how much tax you can save through investment in IDLC Mutual Funds:

You can liquidate your investment in IDLC mutual funds fully or partially anytime by selling directly the units to IDLC Asset Management Limited at the prevailing NAV of the week. Unlike other long-term savings instrument in the market, there is no additional charge or penalty on early liquidation.

Some investors prefer low risk investment with low return, while other may prefer high risk investment with high return. Some may opt for only regular income, while others may want long-term capital appreciation. IDLC Asset Management Limited offer different types of IDLC Mutual Funds catering to these different investment needs of investors.